The past six months worth of results had begun to show some very clear trends, all of which have been completely inverted this survey period, making this one of the biggest turnaround periods we’ve had. Some of these dips may seem alarming, however when it comes to business sales, every cloud has its silver lining.

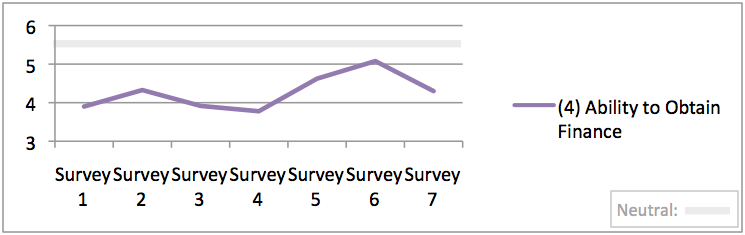

One of the larger turnarounds came from the ability-to-finance-a-business-purchase question (4), in which confidence had been climbing steadily since June. This survey, confidence in this field dropped almost 8%. The unique property of this question is that lending restrictions in Australia, set by the larger lenders, haven’t changed much at all in the past two years. This would suggest that responses to this question are often one of sentiment rather than practice. Perhaps the regular media coverage of the worsening financial situation in Europe is affecting perceptions here in Australia; we’ll just have to wait and see.

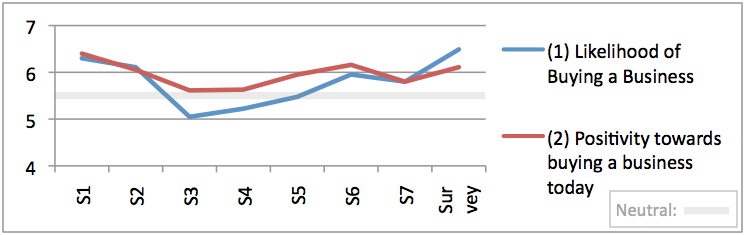

Questions (1) and (2) which pertain to the likelihood-of-buying-a-business and the positivity-of-buying-a-business-today followed their usual trend of moving in tandem, only this month their upward trend took a small downwards turn. The good news is that though confidence in these areas has dropped, they were only small drops and though it’s only by a hair-width, they remain in the positive.

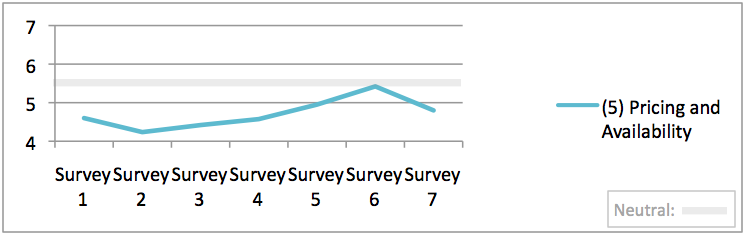

Confidence in business pricing and availability (5) dropped over 6% this survey period heralding its first drop in 12 months. The results to this question have always been a point of interest for us as it is widely accepted that it is a buyer’s market in the business sales industry. (see AIBB’s Australian Businesses for Sale – Market Indicator) Businesses that used to sell for four and five times profit are now selling for two and three times. The fact is, there are some very well priced businesses out there, with a handful of confident buyers taking advantage of them. Five years ago you were paying as much as twice as what you’re paying for businesses now, meaning that if you can finance your purchase, now may be one of the better times to buy low. Though this is not assured, we can assume that once confidence returns, it is likely that business prices will begin to rise again. Which brings us to the final question.

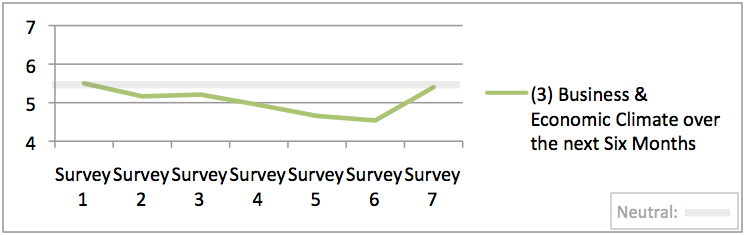

The big surprise came from the question relating to buyer positivity towards the business and economic climate over the next six months (3), which saw its first serious rise since the survey started over 12 months ago. Jumping almost 9% in positivity, buyers’ perceptions of the changing market have moved swiftly back into the neutral after a year of increasing negativity. It could just be a one off result, but it could also be an indication of things to come.

So, is ‘now’ a good time to buy? Realistically, it could go either way and it’s anybody’s guess until we see economic stability return. That said, the fact still remains that businesses are selling for less than they were five years ago, but as to whether you should buy now; that’s up to you.

As usual, we are happy to bring you an analysis of these bi-monthly results as they come in, but we can’t do it without the results. If you have an interest in the outcomes of these figures please take the time to fill in the survey. It’s just five quick questions and it should take you under 60 seconds. Your ongoing assistance in gathering this information is extremely important to us in that it enables us to present up-to-date and relevant information to you. Thanks again in advance for your time. Click here to take the survey.